Adult Learning

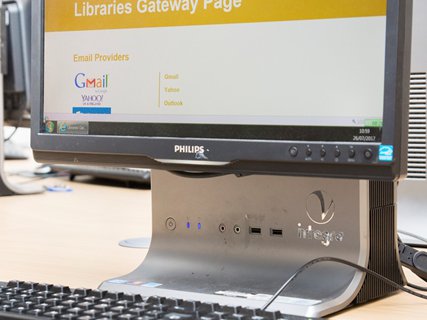

Basic Computer and Internet Skills - Arnold Library - Adult Learning

.

Our new course booking system is live!

Visit our new Learner Hub

to create your account, where you can book and browse all our adult learning courses.

| Date | - |

|---|---|

| Sessions | Wednesdays: 1pm - 3pm |

| No. sessions | 6 |

| Venue | Newark Buttermarket, Exchange Shopping Centre |

| For ages | 19+ |

| Group size | 5 - 12 |

| Cost | FREE - £48 |

Are you thinking about working in a job role e.g. Accounts Trainee or Finance Clerk, but you’re not sure yet if that’s what you want to do? Or perhaps you have previous experience of bookkeeping, but it was a long time ago and you’d like to refresh your skills. Next Steps Bookkeeping for Beginners is suitable for beginners with some knowledge or experience of bookkeeping. You don’t need a maths qualification to attend, but some knowledge or experience of bookkeeping will be beneficial. This is a follow-on course showing you how to process financial documents that underpin accurate record keeping.

You’ll learn, develop, and practice basic bookkeeping skills required for employment and/or career progression in the accounting sector. You’ll also gain the knowledge and understanding for further learning if you wish to aim for AAT Level 2 Bookkeeping, or City & Guilds Level 2 Award in Bookkeeping and Accounts.

The course will focus on a range of financial documents. After posting information from source documents to ledger accounts, you’ll then identify errors in ledger accounts, correct them, and record them in the journal. You’ll produce a revised trial balance. You’ll draw up control accounts and be able to differentiate between capital and revenue expenditure. You’ll prepare a balance sheet. You will learn how to keep the books with an emphasis on recording credit transactions for both a large company and a sole trader. The course focus is on the system of double entry bookkeeping and processing sales, purchase and nominal ledger accounts. By the end of the course, you will have explored and gained confidence in a range of bookkeeping methods, produced clear, correct and legible records and gained skills for employment or for a move to further learning.

By the end of the course, you will be able to:

- Identify the role of the bookkeeper;

- Prepare sales, purchases and nominal ledger accounts, extract a trial balance;

- Correct ledger accounts errors, record in journal, produce a revised trial balance;

- Draw up sales and purchases ledger control accounts;

- Differentiate between capital and revenue expenditure

- Prepare a balance sheet;

- Maintain petty cash using the Imprest system.

What you will need to bring to the course:

You will need access to a basic calculator or use your phone. An email address because links to optional further reading will be shared via email. Although handouts and financial documentation will be provided, a pen and paper or other suitable device to make notes will be useful.

There’s no set textbook for this course, but you may find this library book to be of interest: Frank Wood's business accounting basics / Frank Wood and David Horner. Most bookkeeping books are very similar with useful content, but Frank Wood is one of the most thorough, useful and interesting.

If you receive certain benefits you will be offered the course for free, however if you have a financial barrier which may prevent you from enrolling on the course, please visit our funding page for further information.

Residency in England

To book and enrol on one of our courses, you must be living in England permanently and live outside of the devolved areas listed below or live within the East Midlands Combined County Authority (EMCCA) devolved area (Nottinghamshire, Derbyshire).

Barnsley, Doncaster, Rotherham and Sheffield

Cambridgeshire and Peterborough

Greater London

Greater Manchester

Liverpool City Region

Newcastle Upon Tyne, North Tyneside and Northumberland

Tees Valley

West of England

West Midlands

West Yorkshire

Residency Eligibility – other criteria

If you are living in the UK on a visa we will require evidence of this in order to be funded for the course, you can upload this evidence when you apply for the course. (completion of a questionnaire will be required).

Some exceptions may apply for example

Your visa expiry date must be beyond the end of your course

Asylum seekers must have lived in the UK for 6 months or longer while their claim is being considered by the Home Office

You are receiving local authority support under section 23C or section 23CA of the Children Act 1989 or the Care Act 2014

Any learner who is not funded full cost fees would apply to these courses.

Check the FAQs page, or get in touch: